Saturday Trades Wednesday Update 8/14/2024

Markets mixed – CPI today

Markets have been dull, slow and working higher. All losses from the Monday sell off have been recovered. This morning there is CPI which could create action. However based on what we have been watching it could remain slow.

We would still like to sell rallies although the lack of price action keeps us at bay. You should have had rolls on the calls on the futures trades

Look to sell the extra calls on expiring trades if they start to have value

Set up rolls to midpoint

Roll SPY, QQQ and IWM to Thursday

Futures Ratio Spread

The fills for this will vary, below is the worst of it and this ones profitable.

Sell 6 MES Futures – 5345

Buy to open 5 ATM Calls August 16th 530 Calls

Sell 6 MNQ Futures – 18750

Buy to open 5 ATM Calls August 16th 453 Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

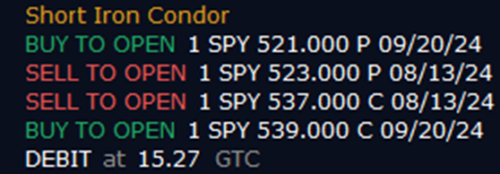

SPY

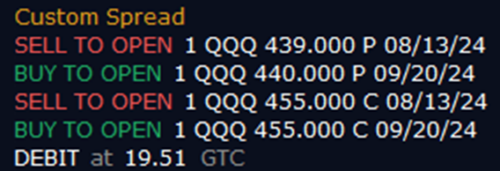

QQQ

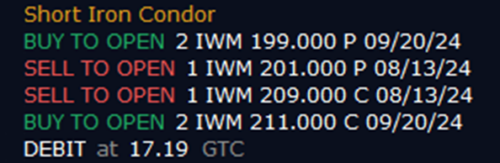

IWM

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

AAPL- (16.12) (2200.00 Credit Collected)

Short 1 August 16th 230 Call

Short 1 August 16th 220 Put

Long 2 August 16th 230 Call

Long 1 August 16th 220 Put

Long 1 August 16th 200 Put

IWM – (12.82) (1560.00 Credit Collected)

Short 1 August 12th 219 Call

Short 1 August 12th 214 Put

Long 2 August 16th 221 Call

Long 1 August 16th 212 Put

Long 1 August 16th 197 Put

MARA- (4.26) (440.00 Credit Collected)

Short 1 August 16th 26 Call

Short 1 August 16th 22 Put

Long 2 August 16th 28 Call

Long 1 August 16th 20 Put

Long 1 August 16th 17 Put

MSFT- (13.70) (1480.00 Credit Collected) CLOSED

Short 1 August 9th 450 Call

Short 1 August 9th 425 Put

Long 1 August 16th 450 Call

Long 1 August 16th 425 Put

TSLA – (23.94) (2545.00 Credit Collected)

Short 1 August 16th 269 Call

Short 1 August 16th 220 Put

Long 2 August 23rd 265 Call

Long 1 August 23rd 215 Put

Long 1 August 23rd 180 Put

SPY – (18.80) (4045.00 Credit Collected)

Short 1 August 12th 557 Call

Short 1 August 12th 564 Put

Long 2 August 16th 566 Call

Long 1 August 16th 555 Put

Long 1 August 16th 510 Put

QQQ – (24.80) (4245.00 Credit Collected)

Short 1 August 12th 501 Call

Short 1 August 12th 492 Put

Long 2 August 16th 505 Call

Long 1 August 16th 490 Put

Long 1 August 16th 425 Put

IWM – (11.80) (2845.00 Credit Collected)

Short 1 August 12th 215 Call

Short 1 August 12th 211 Put

Long 1 August 16th 217 Call

Long 1 August 16th 227 Call

Long 1 August 16th 209 Put

Long 1 August 16th 197 Put

NUGT – (11.90) (1290.00 Credit Collected)

Short 1 August 16th 49 Call

Short 1 August 16th 45 Put

Long 2 August 16th 50 Call

Long 1 August 16th 44 Put

Long 1 August 16th 36 Put

AAPL – (17.43) (3005.00 Credit Collected)

Short 1 August 16th 235 Call

Short 1 August 16th 225 Put

Long 2 August 16th 235 Call

Long 1 August 16th 225 Put

Long 1 August 16th 200 Put

SLV – (5.22) (250.00 Credit Collected)

Short 1 August 16th 28 Call

Short 1 August 16th 28 Put

Long 2 November 15th 29 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put

MRNA – (20.12) (3422.00 Credit Collected)

Short 1 August 16th 125 Call

Short 1 August 16th 110 Put

Long 1 August 16th 125 Call

Long 1 August 16th 130 Call

Long 1 August 16th 110 Put

Long 1 August 16th 80 Put

CHWY – (7.17) (800.00 Credit Collected)

Short 1 August 16th 27 Call

Short 1 August 16th 26 Put

Long 2 August 16th 27.5 Call

Long 1 August 16th 25 Put

Long 1 August 16th 20 Put

NVDA – (24.77) (3300.00 Credit Collected)

Short 1 August 16th 129 Call

Short 1 August 16th 123 Put

Long 1 August 16th 130 Call

Long 1 August 16th 136 Call

Long 1 August 16th 122 Put

Long 1 August 16th 90 Put

ROKU – (13.10) (1853.00 Credit Collected)

Short 1 August 16th 62 Call

Short 1 August 16th 58 Put

Long 2 August 16th 65 Call

Long 1 August 16th 55 Put

Long 1 August 16th 48 Put

GLD – (10.24) (1505.00 Credit Collected)

Short 1 August 14th 215 Call

Short 1 August 14th 215 Put

Long 1 August 16th 220 Call

Long 1 August 16th 230 Call

Long 2 August 16th 210 Put