Saturday Trades Wednesday Update 7/24/2024

Markets under pressure – we will still sell rallies

After Monday’s rally and Tuesday’s attempt to rally, markets are under pressure. We expect this continue and are willing to sell any rally attempt. It appears that markets are headed lower

Roll SPY, QQQ and IWM to Thursday

All of the new orders should have filled as well as many of the rolls at mid +. If you did not fill on TSLA, cancel. Earnings were yesterday

Work the rolls at mid + 10%

If you are in the Futures/options ratio spreads, you can lift the future(buy back and lock in a profit. You can hold the calls, closing the trade or sell them giving a larger profit.

If you are still in the SPY/MES trade there is nothing to do. On both you can sell the futures on the open and buy the ATM calls

UPDATED

•Short 6 MES (micro-S+P) Futures 5667

•Long 5 SPY July 26th 548 Call

New Trade using MNQ and QQQ

•Sell 6 MNQ September Futures 19955

•Buy 5 QQQ July 26th 481 Calls 5.45

Bubba

Exercise and Assignment

Chat Room Link

New Trades

AAPL

IWM

MARA

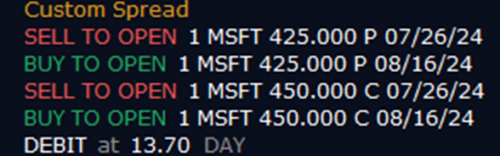

MSFT

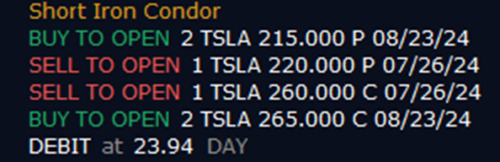

TSLA

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

SPY – (18.80) (1145.00 Credit Collected)

Short 1 July 22nd 557 Call

Short 1 July 22nd 564 Put

Long 2 August 16th 566 Call

Long 1 August 16th 555 Put

Long 1 August 16th 548 Put

QQQ – (24.80) (1145.00 Credit Collected)

Short 1 July 22nd 501 Call

Short 1 July 22nd 492 Put

Long 2 August 16th 505 Call

Long 1 August 16th 490 Put

Long 1 August 16th 475 Put

IWM – (11.80) (845.00 Credit Collected)

Short 1 July 22nd 215 Call

Short 1 July 22nd 211 Put

Long 1 August 16th 217 Call

Long 1 August 16th 227 Call

Long 2 August 16th 209 Put

NUGT – (11.90) (145.00 Credit Collected)

Short 1 July 26th 49 Call

Short 1 July 26th 45 Put

Long 2 August 16th 50 Call

Long 2 August 16th 44 Put

AAPL – (17.43) (345.00 Credit Collected)

Short 1 July 26th 235 Call

Short 1 July 26th 225 Put

Long 2 August 16th 235 Call

Long 2 August 16th 225 Put

SLV – (5.22) (50.00 Credit Collected)

Short 1 July 26th 28 Call

Short 1 July 26th 28 Put

Long 2 November 15th 29 Call

Long 2 November 15th 27 Put

MRNA – (20.12) (780.00 Credit Collected)

Short 1 July 26th 125 Call

Short 1 July 26th 110 Put

Long 1 August 16th 125 Call

Long 1 August 16th 130 Call

Long 2 August 16th 110 Put

CHWY – (7.17) (345.00 Credit Collected)

Short 1 July 26th 27 Call

Short 1 July 26th 26 Put

Long 2 August 16th 27.5 Call

Long 2 August 16th 25 Put

NVDA – (24.77) (1400.00 Credit Collected)

Short 1 July 26th 129 Call

Short 1 July 26th 123 Put

Long 1 August 16th 130 Call

Long 1 August 16th 136 Call

Long 1 August 16th 122 Put

Long 1 August 16th 118 Put

ROKU – (13.10) (545.00 Credit Collected)

Short 1 July 26th 62 Call

Short 1 July 26th 58 Put

Long 2 August 16th 65 Call

Long 2 August 16th 55 Put

GLD – (10.24) (1075.00 Credit Collected)

Short 1 July 24th 215 Call

Short 1 July 24th 215 Put

Long 1 August 16th 220 Call

Long 1 August 16th 225 Call

Long 2 August 16th 210 Put