Saturday Trades Wednesday Update 7/23/2025

The Sounds of Silence – Markets at the highs again

The sounds of silence continue along with the rally. Markets are once again at all time highs on no volume or participation. As we have said many times, overbought or not this rally can continue, and it has.

There will be a selloff at some point but there is no point in predicting when. We will continue top manage our open positions, our earnings trade start today after the close. We will continue to sell premium against our open ratio positions which has worked everyday since we started.

Bottom line, be patient and take what you can get while we wait for a bigger move.

Open Ratio Trades – Keep selling premium against these trades

Sell to open MES September Futures

Buy to open July 25th 5 SPY ATM Calls

Sell to open MNQ September Futures

Buy to open July 26th 5 QQQ ATM Calls

Sell to open M2K September Futures

Buy to open July 25th 5 IWM ATM Calls

Sell to open MYM September Futures

Buy to open July 25th 5 DIA ATM Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

FCX

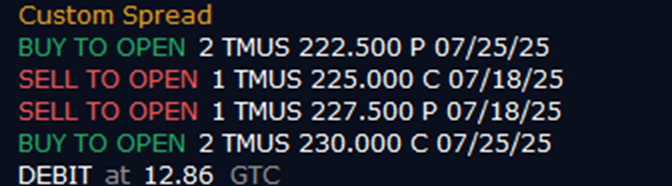

TMUS

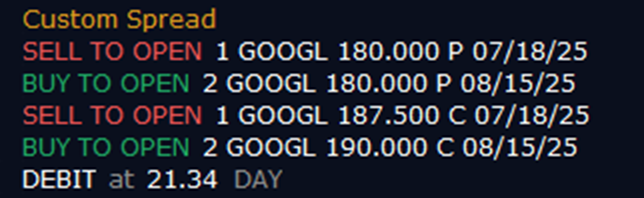

GOOGL