Saturday Trades Wednesday Update 7/2/2025

Markets Churning at the highs

Not much going on as markets churn at the highs. This morning we have ADP Jobs and Thursday non Farm Payroll. Whether or not markets will react either way to these numbers is anyone’s guess.

Markets are slow with little to do. Manage your open trades and be patient, the lack of action is tough

Roll open SPY, and IWM to Thursday

Open Ratio Trades –

Sell to open MES September Futures

Buy to open July 3rd 5 SPY ATM Calls

Sell to open MNQ September Futures

Buy to open July 3rd 5 QQQ ATM Calls

Sell to open M2K September Futures

Buy to open July 3rd 5 IWM ATM Calls

Sell to open MYM September Futures

Buy to open July 3rd 5 DIA ATM Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

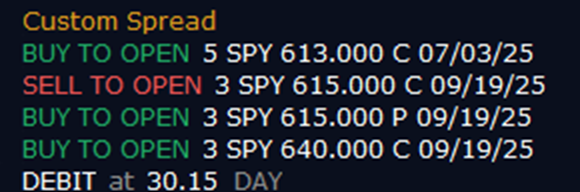

SPY

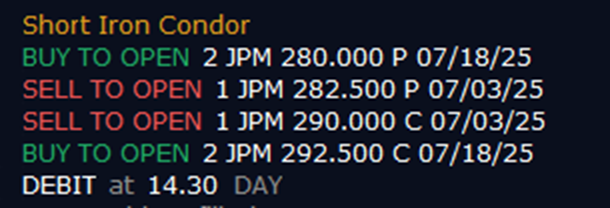

JPM