Saturday Trades Wednesday Update 4/30/2025

Markets remain mixed, with no liquidity

Remember no call Saturday, I’m leaving for Chicago this morning

Markets remain in purgatory, no volume, high volatility and no liquidity. There is a ton of news the rest of the week, starting with ADP jobs this morning and earnings galore.

The news could break the markets out of the quiet trade or this malaise can continue. The next three trading days are the key to what happens next.

Most have filled on the new trades, if not cancel

Roll SPY, QQQ, and IWM to Thursday

Bubba

Exercise and Assignment

Chat Room Link

New Trades

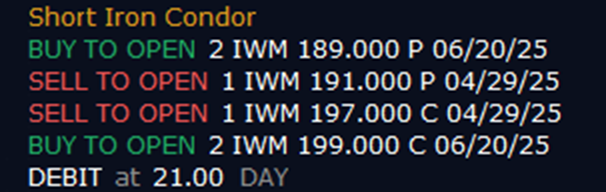

IWM

QQQ

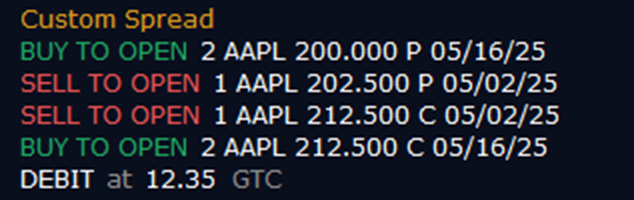

AAPL

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

SLV

Long 5 May16th 29.5 Calls

Short 5 May 16th 29.5 Puts

Long 5 May 16th 27.5 Puts

SPY – (15.42) (700.00 Credit Collected)

Short 2 April 28th 540 Call

Short 1 April 28th 512 Put

Long 2 May 16th 542 Call

Long 2 May 16th 510 Put

NUGT

Long 2 April 25th 77 Calls

Short 3 June 20th 35 Calls

Long 3 June 20th 75 Calls

MARA – (11.48) (1200.00 Credit Collected)

Short 1 April 25th 18 Call

Short 1 April 25th 16 Put

Long 2 June 20th 18 Call

Long 1 June 20th 16 Put