Saturday Trades Wednesday Update 2/26/2025

Market higher, Sell the rally

Once again this morning markets are higher, for the past 3 days we have watched higher opens be sold hard. We expect this action to continue and will sell the rally

All of our Futures/Options trades have closed out the futures side at big profits. We are only stuck in the Gold trade for now.

Roll SPY, IWM, and QQQ to Thursday

Futures/Options trades –

Sell 6 MES Futures 6067 CLOSED

Buy 5 ATM February 28th SPY 600 Calls 5.00

Sell 6 MYM Futures Trading 44700 CLOSED

Buy 5 ATM February 28th DIA 434 Calls 3.75

Sell 6 MGC Futures 2857

Buy 5 ATM February 28th GLD 271 Calls 2.00

Sell 6 MNQ 22261 Closed +4000

Buy 5 QQQ 540 Calls for February 28th 6.50

Bubba

Exercise and Assignment

Chat Room Link

New Trades

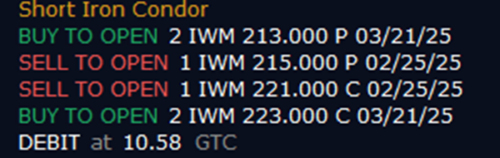

IWM

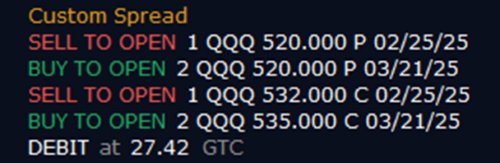

QQQ