Saturday Trades Wednesday Update 11/20/2024

Markets higher, the dull rally continues – Look for resistance levels to sell

The slow dull rally continues, we are looking for a spot to sell. However, we must wait for some speed and action to show before we can sell. Be patient, our time will come

Roll New SPY, QQQ, and IWM to Thursday

Futures Options Trades – Open Position

Sell 6 MES Futures – 5910

Buy to open 5 November 22nd 587 Call 4.24

Sell 6 MNQ Futures – 20680

Buy to open 5 November 22nd 497 Calls 5.60

Buy 6 MGC Futures – 2627

Buy to open 5 GLD ATM November 22nd 242.5 Puts 1.59

Buy 6 MYM Futures – 43164

Buy to open 5 DIA ATM November 22nd 431 Puts 3.25

Bubba

Exercise and Assignment

Chat Room Link

New Trades

DIA

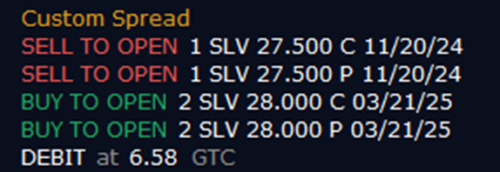

SLV

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

VXX – (.75) (Credit Collected)

Long 5 November 22nd 45 Call

Short 5 November 22nd 45 Put

Long 5 November 22nd 43 Call

SPY – (28.77) (1000.00 Credit Collected)

Short 1 November 18th 601 Call

Short 1 November 18th 595 Put

Long 2 December 20th 603 Call

Long 1 December 20th 593 Put

Long 1 December 20th 585 Put

QQQ – (33.41) (1100.00 Credit Collected)

Short 1 November 18th 518 Call

Short 1 November 18th 507 Put

Long 2 December 20th 520 Call

Long 1 December 20th 505 Put

Long 1 December 20th 495 Put

AAPL – (13.71) (750.00 Credit Collected)

Short 1 November 22nd 240 Call

Short 1 November 22nd 222.5 Put

Long 2 December 20th 245 Call

Long 2 December 20th 220 Put

IWM – (26.68) (2600.00 Credit Collected)

Short 1 November 18th 228 Call

Short 1 November 18th 224 Put

Long 1 December 20th 230 Call

Long 1 December 20th 243 Call

Long 1 December 20th 222 Put

Long 1 December 20th 218 Put