Saturday Trades Tuesday Update 9/17/2024

Markets Quiet and Higher

Markets are quiet and higher, we expect very little activity until Wednesday afternoon. That doesn’t mean there won’t be a little volatility off the news this morning. However, our expectations are to see the markets end near unchanged.

I will look to sell the extra expiring calls and also work a futures order that will take off my futures at a profit for the trade

AAPL filled, you can work the other new orders as written

Roll SPY, QQQ, and IWM to Wednesday

Futures Ratio Spread – Everyone should have sold the futures and locked in nice profits. We are holding the September 20th Puts for Free

Buy 6 MES Futures – 5425 Closed

Buy to open 5 ATM 542 6.00 Puts for September 20th – Open

Buy 6 MNQ Futures – 18670 Closed

Buy to open 5 ATM 454 Puts 7.00 for September 20th – Open

NEW Futures Options Trade put on this morning

Sell 6 MES Futures –

Buy to open 5 ATM Calls September 20th

Sell 6 MNQ Futures –

Buy to open 5 ATM Calls September 20th

Bubba

Exercise and Assignment

Chat Room Link

New Trades

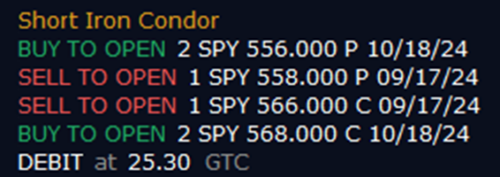

SPY

IWM