Saturday Trades Tuesday Update 8/20/2024

Markets continue Higher

The rally continues on no volume. It appears that new highs are coming. The real problem is the lack of price action and market participation. We are in good shape either way

All new trades filled for some, if you didn’t fill, work the orders again today. For SPY and QQQ move the sell side to tomorrow if not filled and midpoint to enter.

Roll SPY, QQQ , and IWM to Wednesday. If you made any of the adjustments below, roll accordingly

On the open calendars, you have 3 choices.

1. Do nothing and continue daily rolls

2. Roll up both the long and short calls to around the money

3. Roll up the September call creating a short position

Futures Ratio Spread

Sell 6 MES Futures – 5578

Buy to open 5 ATM Calls August 23rd 555 Calls

Sell 6 MNQ Futures – 19605

Buy to open 5 ATM Calls August 16th 475 Calls

Bubba

Exercise and Assignment

Chat Room Link

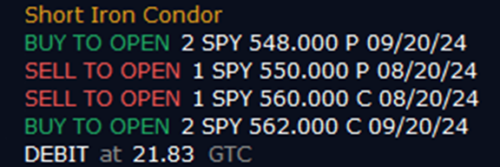

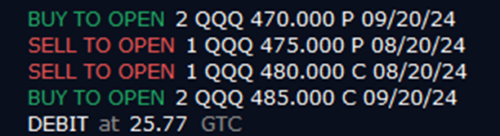

New Trades

SPY

QQQ

NVDA

COIN

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

SPY – (15.27) (300.00 Credit Collected)

Short 1 August 19th 537 Call

Short 1 August 19th 523 Put

Long 1 September 20th 539 Call

Long 1 September 20th 521 Put

IWM – (17.19) (200.00 Credit Collected)

Short 1 August 19th 209 Call

Short 1 August 19th 201 Put

Long 2 September 20th 211 Call

Long 2 September 20th 199 Put

QQQ – (19.51) (300.00 Credit Collected)

Short 1 August 19th 455 Call

Short 1 August 19th 439 Put

Long 1 September 20th 455 Call

Long 1 September 20th 439 Put

SLV – (5.22) (250.00 Credit Collected)

Short 1 August 16th 28 Call

Short 1 August 16th 28 Put

Long 2 November 15th 29 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put