Saturday Trades Tuesday Update 7/15/2025

Markets higher with CPI this morning

Markets recovered Monday, and once again overnight into this morning. For now every dip gets bought, markets continue to make highs. This is typical for dull, slow markets.

This morning the CPI number comes out, what it means or what the markets will do is anyone’s guess. The number should create some action but after I expect the dull market to continue

Roll open SPY, and IWM to Wednesday

This week’s call will be Wednesday at Noon EST

Open Ratio Trades – Roll Calls to July 18th

Sell to open MES September Futures

Buy to open July 18th 5 SPY ATM Calls

Sell to open MNQ September Futures

Buy to open July 18th 5 QQQ ATM Calls

Sell to open M2K September Futures

Buy to open July 18th 5 IWM ATM Calls

Sell to open MYM September Futures

Buy to open July 18th 5 DIA ATM Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

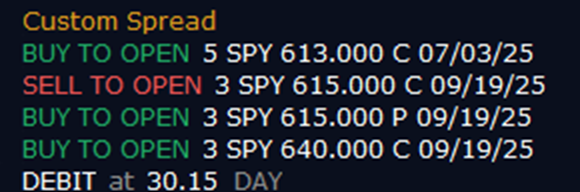

SPY