Saturday Trades Tuesday Update 2/4/2025

Tariffs partially on Hold, markets rally

Markets rallied late Monday on tariffs being put on hold. You can buy into that or you can realize the markets are on edge and are looking to go lower.

We will see how they play out today, they are mixed at the moment. I would be a seller of rallies

Roll IWM, and SPY, to Wednesday

You can enter the new trades from Saturday, it is possible may may have filled after yesterdays midday update

Futures/Options trades –

Sell 6 MES Futures 6067

Buy 5 ATM February 7th SPY 602 Calls 5.14

Sell 6 MYM Futures Trading 44700

Buy 5 ATM February 7th DIA 445 Calls 3.85

Sell 6 MNQ Futures 21813 CLOSED

Buy 5 ATM February 7th QQQ 528 Calls 5.20

Sell 6 MGC Futures 2857

Buy 5 ATM February 7th GLD 259 Calls 2.31

Bubba

Exercise and Assignment

Chat Room Link

New Trades

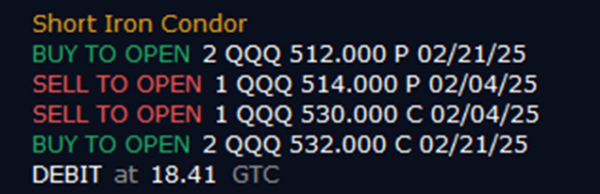

QQQ

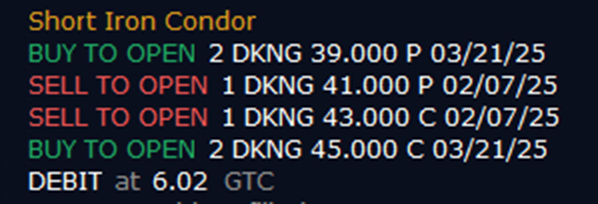

DKNG

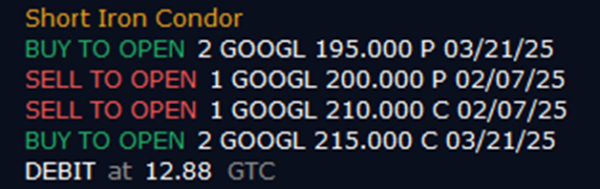

GOOGL