Saturday Trades Tuesday Update 10/8/2024

Monday’s sell off leads to Tuesday’s Bounce

Monday saw a solid sell off, this morning markets are higher. We expect the markets to continue in consolidation until Thursday when the CPI numbers come out.

The tight consolidation will end, Thursday is the most likely but not a guaranty. Either way we will trade the patterns looking for opportunity.

GOOGL FILLED< WORK JPM TODAY SAME PRICE

Roll SPY, QQQ, and IWM to Wednesday

NO FUTURES OPTIONS TRADES , WE ARE WAITING ON A NEW TRADE HERE. FOR NOW VOLATILITY TOO HIGH TO DO ANYTHING AT THE CURRENT LEVELS

Sell 6 MES Futures –

Buy to open 5

Sell 6 MNQ Futures

Buy to open 5

Bubba

Exercise and Assignment

Chat Room Link

New Trades

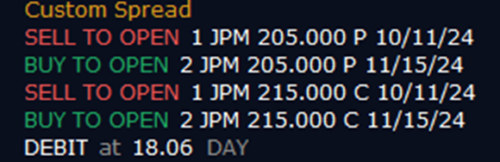

JPM

GOOGL

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

AMZN- (26.04) (400.00 Credit Collected)

Short 1 October 11th 192.5 Call

Short 1 October 11th 185 Put

Long 2 October 18th 195 Call

Long 2 October 18th 185 Put

QQQ – (20.72) (900.00 Credit Collected)

Short 1 October 7th 487 Call

Short 1 October 7th 477 Put

Long 2 October 18th 490 Call

Long 2 October 18th 475 Put

SPY – (19.60) (900.00 Credit Collected)

Short 1 October 7th 573 Call

Short 1 October 7th 563 Put

Long 2 October 18th 575 Call

Long 2 October 18th 561 Put

IWM – (11.59) (500.00 Credit Collected)

Short 1 October 7th 215 Call

Short 1 October 7th 219 Put

Long 2 October 18th 227 Call

Long 2 October 18th 217 Put

AAPL – (16.62) (1200.00 Credit Collected)

Short 1 October 11th 225 Call

Short 1 October 11th 220 Put

Long 1 October 18th 225 Call

Long 1 October 18th 230 Call

Long 1 October 18th 220 Put

Long 1 October 18th 215 Put

COIN – (29.33) (3000.00 Credit Collected)

Short 1 October 11th 160 Call

Short 1 October 11th 140 Put

Long 1 October 18th 165 Call

Long 1 October 18th 190 Call

Long 2 October 18th 135 Put

DIA – (17.05) (1600.00 Credit Collected)

Short 1 October 11th 410 Call

Short 1 October 11th 398 Put

Long 1 October 18th 412 Call

Long 1 October 18th 426 Call

Long 2 October 18th 396 Put

NVDA – (17.70) (2100.00 Credit Collected)

Short 1 October 11th 106 Call

Short 1 October 11th 100 Put

Long 1 October 18th 108 Call

Long 1 October 18th 128 Call

Long 2 October 18th 98 Put

MARA – (5.97) (600.00 Credit Collected)

Short 1 October 11th 19 Call

Short 1 October 11th 18 Put

Long 2 October 18th 20 Call

Long 1 October 18th 17 Put

Long 1 October 18th 13 Put

SLV – (5.22) (550.00 Credit Collected)

Short 1 October 7th 28 Call

Short 1 October 7th 28 Put

Long 2 November 15th 29 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put