Saturday Trades Tuesday Update 10/15/2024

Strange action, issues in the middles east – Markets lower, Crude crushed

Markets are mixed to lower while crude is getting crushed. Last night during the Monday Night Call. Oil and gold got hammered. There was talk of an attack in Israel.

Take a look at the markets, they are barely reacting, in fact they are not low enough to resolve the overbought conditions. Just be patient and disciplined, pick your spots.

We added one new trade yesterday that filled for most, you can work again today if not filled

Roll SPY, QQQ, and IWM to Wednesday

We are going to short the Futures and Buy the at the money calls for October 18th. The prices posted below are approx. The trade is good whatever prices you get

Sell 6 MES Futures – 5865

Buy to open 5 October 18th 580 3.91

Sell 6 MNQ Futures – 20475

Buy to open 5 October 18th 494 4.38

Bubba

Exercise and Assignment

Chat Room Link

New Trades

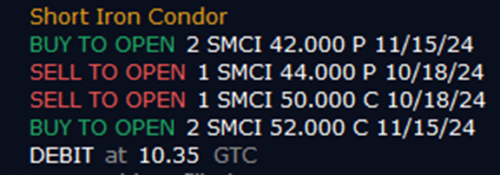

SMCI

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

JPM- (18.06) (500.00 Credit Collected)

Short 1 October 18th 215 Call

Short 1 October 18th 205 Put

Long 1 November 15th 215 Call

Long 1 November 15th 220 Call

Long 2 November 15th 205 Put

GOOGL- (18.71) (500.00 Credit Collected)

Short 1 October 18th 170 Call

Short 1 October 18th 162.5 Put

Long 2 November 15th 170 Call

Long 2 November 15th 160 Put

AMZN- (26.04) (700.00 Credit Collected)

Short 1 October 18th 192.5 Call

Short 1 October 18th 185 Put

Long 2 November 15th 195 Call

Long 2 November 15th 185 Put

QQQ – (20.72) (2000.00 Credit Collected)

Short 1 October 14th 487 Call

Short 1 October 14th 477 Put

Long 1 October 18th 490 Call

Long 1 October 18th 495 Call

Long 2 October 18th 475 Put

SPY – (19.60) (1700.00 Credit Collected)

Short 1 October 14th 573 Call

Short 1 October 14th 563 Put

Long 1 October 18th 575 Call

Long 1 October 18th 580 Call

Long 2 October 18th 561 Put

IWM – (11.59) (1200.00 Credit Collected)

Short 1 October 14th 215 Call

Short 1 October 14th 219 Put

Long 2 October 18th 227 Call

Long 1 October 18th 217 Put

Long 1 October 18th 215 Put

AAPL – (16.62) (1500.00 Credit Collected)

Short 1 October 18th 225 Call

Short 1 October 18th 220 Put

Long 1 October 18th 225 Call

Long 1 October 18th 230 Call

Long 1 October 18th 220 Put

Long 1 October 18th 215 Put

COIN – (29.33) (3300.00 Credit Collected)

Short 1 October 18th 160 Call

Short 1 October 18th 140 Put

Long 1 October 18th 165 Call

Long 1 October 18th 190 Call

Long 2 October 18th 135 Put

DIA – (17.05) (2000.00 Credit Collected)

Short 1 October 18th 410 Call

Short 1 October 18th 398 Put

Long 1 October 18th 412 Call

Long 1 October 18th 430 Call

Long 2 October 18th 396 Put

NVDA – (17.70) (2700.00 Credit Collected)

Short 1 October 18th 106 Call

Short 1 October 18th 100 Put

Long 1 October 18th 108 Call

Long 1 October 18th 135 Call

Long 2 October 18th 98 Put

MARA – (5.97) (700.00 Credit Collected)

Short 1 October 18th 19 Call

Short 1 October 18th 18 Put

Long 2 October 18th 20 Call

Long 1 October 18th 17 Put

Long 1 October 18th 13 Put

SLV – (5.22) (600.00 Credit Collected)

Short 1 October 14th 28 Call

Short 1 October 14th 28 Put

Long 2 November 15th 29 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put