Saturday Trades Tuesday Update 1/14/2025

The Bounce started yesterday -continuing this morning

Yesterday mid- morning, buyers started to show, By the end of the day markets were higher except the Nasdaq. This morning all markets are rallying and could run for a while.

The rally is good for our rolls and the futures options trades. At some point we will become sellers again, for now we play the rally

Both new trades filled

Roll SPY, both IWM, and QQQ to Wednesday

NEW TRADES Futures/Options

These are current prices, Just get filled where you can

Buy 6 MES Futures 5828

Buy 5 ATM Jan 17 SPY Puts 577 Puts 5.00

Buy 6 MNQ Futures 20790 – Future should be closed with a 4K profit

Buy 5 ATM Jan 17QQQ 502 Puts 5.80

Buy 6 MGC Futures 2690

Buy 5 ATM Jan 17 GLD247 Puts 1.70

Bubba

Exercise and Assignment

Chat Room Link

New Trades

BA

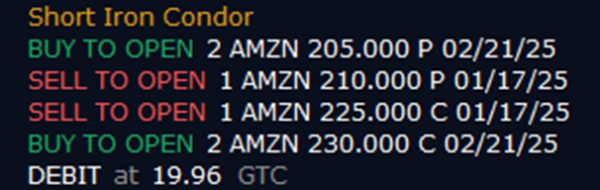

AMZN

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

IWM – (18.02) (100.00 Credit Collected)

Short 1 January 13th 221 Call

Short 1 January 13th 217 Put

Long 2 February 21st 223 Call

Long 2 February 21st 215 Put

JPM – (21.25) (600.00 Credit Collected)

Short 1 January 17th 247.5 Call

Short 1 January 17th 242.5 Put

Long 2 February 21st 250 Call

Long 2 February 21st 240 Put

IWM – (14.31) (1700.00 Credit Collected)

Short 1 January 13th 236 Call

Short 1 January 13th 231 Put

Long 2 January 17th 238 Call

Long 1 January 17th 229 Put

SPY- (2030.00) (2300.00 Credit Collected)

Short 1 January 13th 609 Call

Short 1 January 13th 600 Put

Long 2 January 24th 611 Call

Long 1 January 24th 600 Put

QQQ- (29.62) (3200.00 Credit Collected)

Short 1 January 13th 542 Call

Short 1 January 13th 530 Put

Long 2 January 24th 544 Call

Long 1 January 24th 528 Put

SLV – (6.58) (550.00 Credit Collected)

Short 1 January 13th 27.5 Call

Short 1 January 13th 27.5 Put

Long 2 March 21st 28 Call

Long 1 March 21st 28 Put

Long 1 March 21st 27 Put