Saturday Trades Thursday Update 7/24/2025

Markets pop on earnings Wednesday – Mixed this morning

Markets were slow all day Wednesday until a late day and after market pop on Earnings. The action is still slow and really should be observed. Based on overnight pricing we have adjustments to make to our open positions.

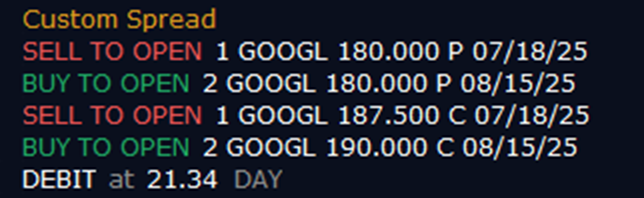

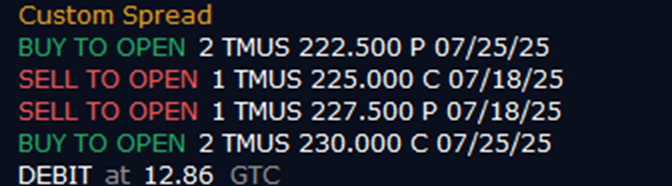

Our open earnings trades shorts should be rolled to next week same strikes. On TMUS, roll the extra call up to the at the money call or sell the ATM call (I sold), GOOGL, roll up the extra call.

Things can change before the actual opening on the extra options but on the shorts they must be rolled.

Open Ratio Trades – Keep selling premium against these trades

Sell to open MES September Futures

Buy to open July 25th 5 SPY ATM Calls

Sell to open MNQ September Futures

Buy to open July 26th 5 QQQ ATM Calls

Sell to open M2K September Futures

Buy to open July 25th 5 IWM ATM Calls

Sell to open MYM September Futures

Buy to open July 25th 5 DIA ATM Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

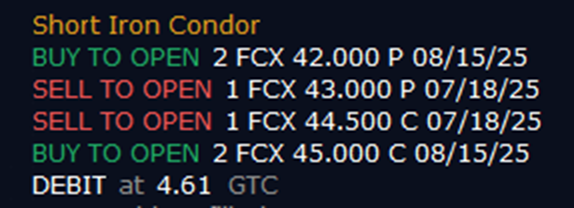

FCX

TMUS

GOOGL