Saturday Trades Monday Update 9/30/2024

Market quiet, slightly lower

Markets quietly lower, they have been quiet since last nights opening. With today being the end of month and quarter, we could see a rally.

Today could go either way, I will be looking to sell rallies.

Roll SPY, QQQ, and IWM to Tuesday

HAVE ORDERS WORKING ON THE FUTURES, THERE COULD BE WILD SWINGS

Sell 6 MES Futures – 5791

Buy to open 5 571 Calls October 4th

Sell 6 MNQ Futures – 20221

Buy to open 5 487 Calls October 4th

Bubba

Exercise and Assignment

Chat Room Link

New Trades

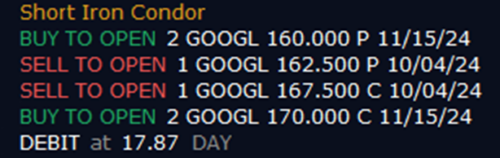

GOOGL

AMZN