Saturday Trades Monday Update 2/10/2025

Markets running higher with Gold and Crude

Markets flying higher along with Gold, Crude, and Bitcoin. Volume is light and there isn’t much action. We will look for an opportunity to sell and roll up our calls from the ratio trades.

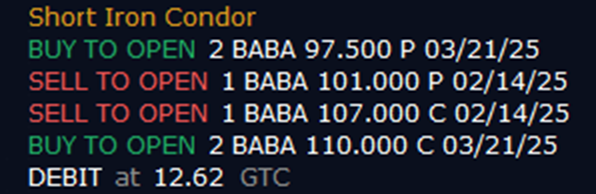

On the new trades, NVDA is good as written, Cancel BABA and we will watch it today

Roll IWM, QQQ, and SPY, to Tuesday

Futures/Options trades –

Sell 6 MES Futures 6067

Buy 5 ATM February 14th SPY 601 Calls 4.88

Sell 6 MYM Futures Trading 44700

Buy 5 ATM February 7th DIA 443 Calls 3.85

Sell 6 MGC Futures 2857

Buy 5 ATM February 7th GLD 264 Calls 2.31

Bubba

Exercise and Assignment

Chat Room Link

New Trades

NVDA

BABA