Saturday Trades Friday Update 7/19/2024

The Selling has begun

Saturday Call registration, pregame starts at 9:00 EST

Password: 888848

Yesterday we wrote the the markets appeared ready to sell off, they have. We could see selling intensify which would be no surprise. After making new highs day after day, this is a natura sell off, which is good for our positions.

All rolls should be filled,

Roll SPY, QQQ and IWM to Monday

We will post all orders as filled, I know this was a mixed week, some were filled on the adjusted price, some didn’t adjust. It’s no big deal either way, we will have many trades for next week tomorrow.

Ratio Spread using Futures and Options +250.00 Last week

•Short 6 MES (micro-S+P) Futures 5667

•Long 5 SPY July 19th 561 Call

Bubba

Exercise and Assignment

Chat Room Link

New Trades

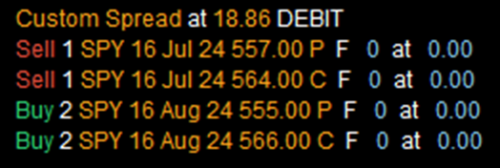

SPY

QQQ

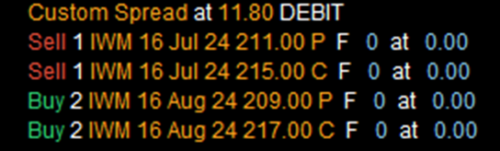

IWM

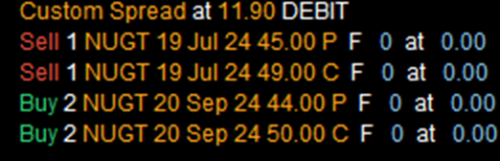

NUGT

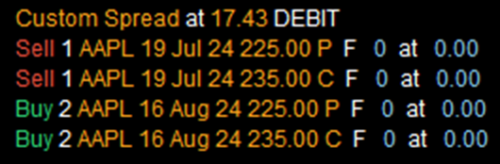

AAPL

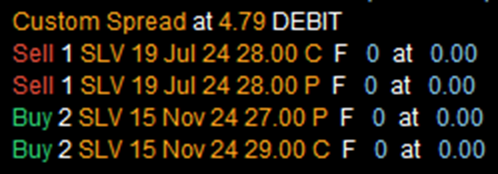

SLV

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

MRNA – (20.12) (480.00 Credit Collected)

Short 1 July 19th 125 Call

Short 1 July 19th 110 Put

Long 1 August 16th 125 Call

Long 1 August 16th 130 Call

Long 2 August 16th 110 Put

CHWY – (7.17) (205.00 Credit Collected)

Short 1 July 19th 27 Call

Short 1 July 19th 26 Put

Long 2 August 16th 27.5 Call

Long 2 August 16th 25 Put

NVDA – (24.77) (1000.00 Credit Collected)

Short 1 July 19th 129 Call

Short 1 July 19th 123 Put

Long 1 August 16th 130 Call

Long 1 August 16th 136 Call

Long 1 August 16th 122 Put

Long 1 August 16th 120 Put

ROKU – (13.10) (545.00 Credit Collected)

Short 1 July 19th 62 Call

Short 1 July 19th 58 Put

Long 2 August 16th 65 Call

Long 2 August 16th 55 Put

IWM – (8.36) (1400.00 Credit Collected)

Short 1 July 12th 202 Call

Short 1 July 12th 198 Put

Long 1 July 19th 204 Call

Long 2 July 19th 196 Put

JPM – (10.28) (900.00 Credit Collected)

Short 1 July 19th 200 Call

Short 1 July 19th 190 Put

Long 1 July 19th 200 Call

Long 1 July 19th 210 Call

Long 2 July 19th 190 Put

GLD – (10.24) (875.00 Credit Collected)

Short 1 July 15th 215 Call

Short 1 July 15th 215 Put

Long 1 August 16th 220 Call

Long 1 August 16th 225 Call

Long 2 August 16th 210 Put

SPY – (20.22) (1840.00 Credit Collected)

Short 1 July 12th 546 Call

Short 1 July 12th 536 Put

Long 1 July 19th 548 Call

Long 2 July 19th 534 Put

QQQ – (20.22) (2600.00 Credit Collected)

Short 1 July 12th 482 Call

Short 1 July 12th 472 Put

Long 1 July 19th 485 Call

Long 2 July 19th 470 Put

NUGT – (7.25) (1100.00 Credit Collected)

Short 1 July 19th 37 Call

Short 1 July 19th 35 Put

Long 1 July 19th 37 Call

Long 1 July 19th 48 Call

Long 2 July 19th 35 Put

AAPL – (10.10) (1425.00 Credit Collected)

Short 1 July 19th 215 Call

Short 1 July 19th 210 Put

Long 1 July 19th 220 Call

Long 1 July 19th 210 Put

RIOT – (3.05) (350.00 Credit Collected)

Short 1 July 19th 10.5 Call

Short 1 July 19th 10 Put

Long 2 July 19th 11 Call

Long 2 July 19th 9 Put

MARA – (8.21) (740.00 Credit Collected)

Short 1 July 19th 22 Call

Short 1 July 19th 20 Put

Long 2 July 19th 23 Call

Long 1 July 19th 19 Put

Long 1 July 19th 18 Put