Saturday Trades Friday Update 3/21/2025

Markets slightly higher on the week, Triple Witching Friday, anything goes

Saturday Call registration, pregame starts at 9:00 EST

Password: 888848

Markets have whipped around this week, although they are lower this morning, they are higher on the week. The action has been light leaving us with little to do.

Most of our options trades close today, they are all profitable. The only thing to day, close the extra options if they have value. Also you can close the short call or put spreads if you choose. I will only close if the spread is split, part in the money and part out

On the open Ratio Trades, late in the day, roll the Puts in MES, and the Calls in Gold to next week.

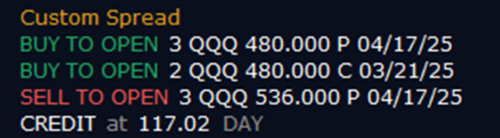

On the new QQQ trade, you should have rolled the 2 March 21st 480 calls to 485 for a credit. These calls will probably expire worthless, But to open 2 Calls for next week at the end of the day

Roll SPY, IWM, and QQQ to Monday

Futures/Options trades –

Buy 6 MES Futures –

Buy 5 March 21st SPY ATM Puts

Sell 6 MGC Futures

Buy 5 ATM March 21st GLD

Bubba

Exercise and Assignment

Chat Room Link

New Trades

QQQ