Saturday Trades Friday Update 1/17/2025

Markets Higher – Volatility falling, what’s next?

Saturday Call registration, pregame starts at 9:00 EST

Password: 888848

Markets higher this morning, the VIX is falling which could allow the rally to continue. With the markets closed Monday, today could be slow.

We have expiring trades today, SPY, QQQ, and one of the IWM trades. Dell the rest of the extra calls if they have value

Roll IWM to Monday

NEW TRADES Futures/Options –

On the Futures/Options trades that we own the options only, sell them today for whatever value you can, if any.

Sell 6 MES Futures 6000 –

Buy 5 ATM Jan 24 SPY Puts 593 Calls 5.00

Buy 5 ATM Jan 17 QQQ 502 Puts 5.80

Buy 5 ATM Jan 17 GLD 247 Puts 1.70

Bubba

Exercise and Assignment

Chat Room Link

New Trades

BA

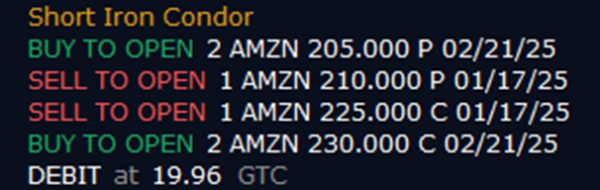

AMZN

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

IWM – (18.02) (100.00 Credit Collected)

Short 1 January 13th 221 Call

Short 1 January 13th 217 Put

Long 2 February 21st 223 Call

Long 2 February 21st 215 Put

JPM – (21.25) (600.00 Credit Collected)

Short 1 January 17th 247.5 Call

Short 1 January 17th 242.5 Put

Long 2 February 21st 250 Call

Long 2 February 21st 240 Put

IWM – (14.31) (1700.00 Credit Collected)

Short 1 January 13th 236 Call

Short 1 January 13th 231 Put

Long 2 January 17th 238 Call

Long 1 January 17th 229 Put

SPY- (2030.00) (2300.00 Credit Collected)

Short 1 January 13th 609 Call

Short 1 January 13th 600 Put

Long 2 January 24th 611 Call

Long 1 January 24th 600 Put

QQQ- (29.62) (3200.00 Credit Collected)

Short 1 January 13th 542 Call

Short 1 January 13th 530 Put

Long 2 January 24th 544 Call

Long 1 January 24th 528 Put

SLV – (6.58) (550.00 Credit Collected)

Short 1 January 13th 27.5 Call

Short 1 January 13th 27.5 Put

Long 2 March 21st 28 Call

Long 1 March 21st 28 Put

Long 1 March 21st 27 Put