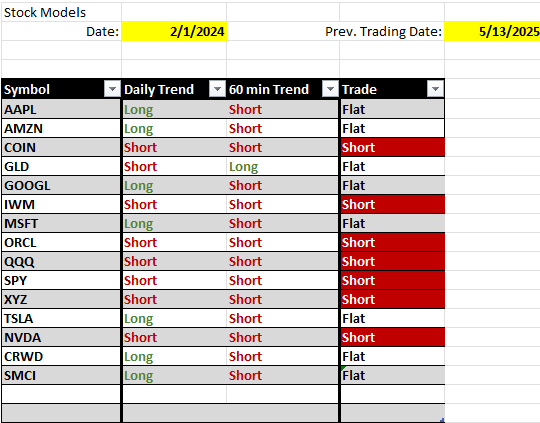

Bubba’s Equity Portfolios Weekly Update No New Trades 6/14/2025

ASSIGNMENT VIDEO

The cash S&P 500 was down 23.39 for the week, but created a “key reversal” meaning we had a higher high than the prior week but a lower close. In addition, this week’s high ran into late January and February resistance.

The algorithm went short several stocks before Friday’s news event, so it acted on overbought conditions that we sell- always. Most stocks are nearer their highs than their lows, which means we can only sell. We buy low and sell high based on a proprietary form of a standard deviation model.

Trading was profitable this week.

1A +524

2A +102

*There are no new trades*

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios 6/14/2025

1A – 25K

2A – 18K