Bubba’s Equity Portfolios Weekly Update No New Trades 5/3/2025

ASSIGNMENT VIDEO

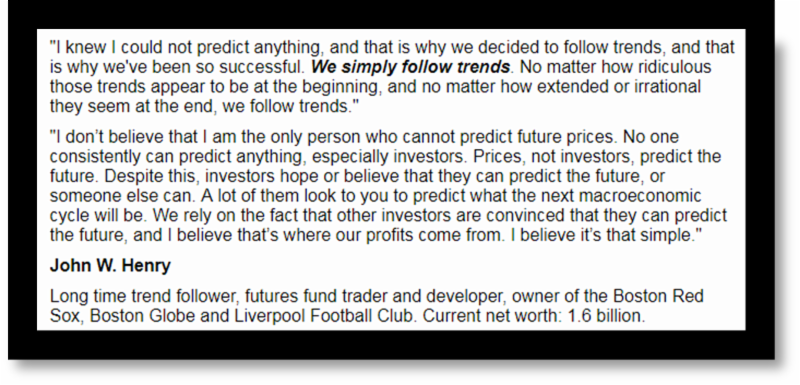

The cash S&P 500 was up a massive 403.97 for the week and the bears are still adamant that we will see lower prices. Profitable traders react to price action and go with the trend- they do not make forecasts.

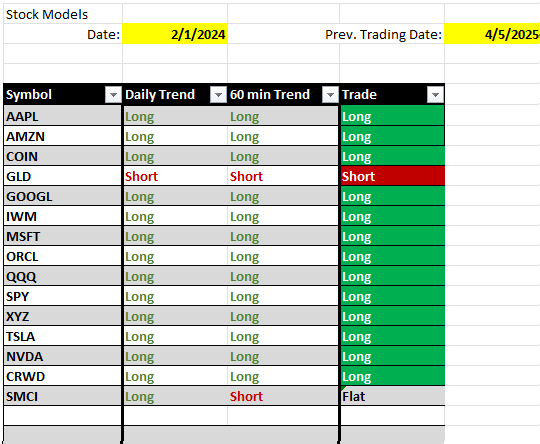

Many individual stock and ETFs have extremely large open trade profits. Because the Stock Model Portfolios are long all but two issues, we had large profits this week.

The algorithm’s stops are moving up quickly on open trades, so we are unlikely to give back much of what has been gained in the past few weeks.

1A +9365

2A +4233

*There are no new trades*

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios 5/3/2025

1A – 25K

2A – 18K