Bubba’s Equity Portfolios Weekly Update No New Trades 4/18/2025

ASSIGNMENT VIDEO

The cash S&P 500 was -80.66 for the week. We are solidly in a congestion zone with the VIX declining from stratospheric levels.

Have we seen the bottom in the stock market? Far too early to tell. Short and intermediate term trends are clearly down.

We lost some money this week in the stock options program.

1A -3487

2A -1820

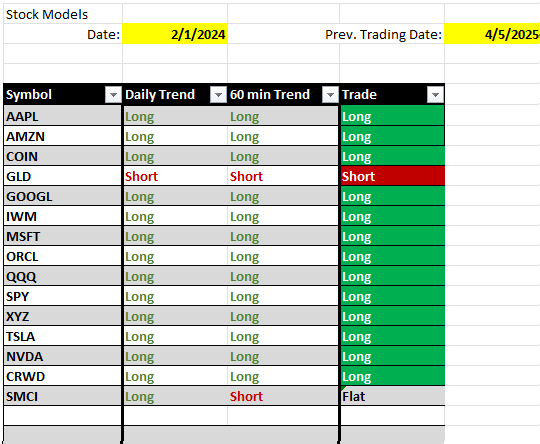

*There are no new trades*

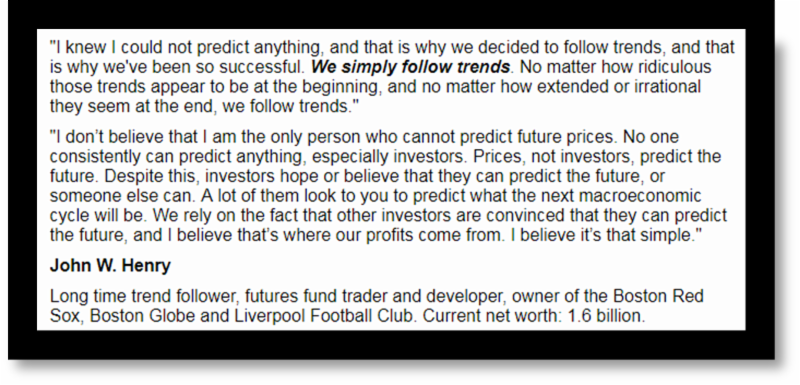

Amateur traders are always looking for the “why” in trading when they should only focus of the “that” because we don’t know whys- but we do know the that. If a market is making higher highs and higher lows, “that” is the very definition of an uptrend. We usually will never know “why” a market does anything. Most losers in the markets think they must have reasons for making a trade based on all kinds of subjective junk. Not us.

Our method is objective, and 100% rule based. There is nothing to understand other than what the algorithm is telling us. Follow the rules and make money- it’s that simple.

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios 4/19/2025

1A – 25K

2A – 18K