Bubba’s Equity Portfolios Weekly Update New Trades 12/28/2024

The S&P 500 was +41.4 for the week. We have a mix of long and short positions and both can be winners- time will tell.

The option stock portfolios has two winners and one loser.

1A -2534

2A +183

3A +1169

*New Trade Alert*

Sell AAPL (1A/2A/3A)

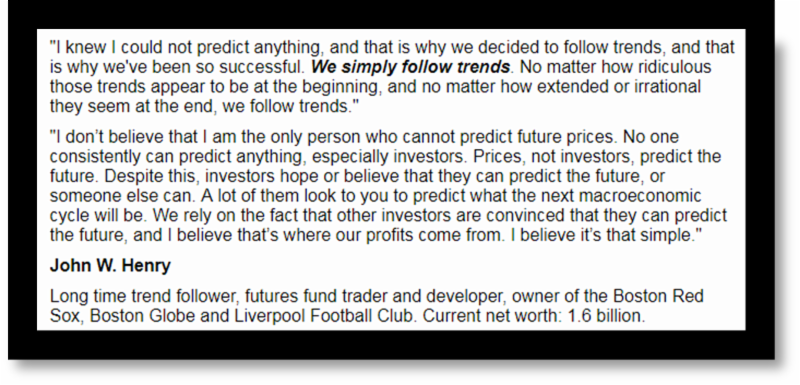

Amateur traders are always looking for the “why” in trading when they should only focus of the “that” because we don’t know whys- but we do know the that. If a market is making higher highs and higher lows, “that” is the very definition of an uptrend. We usually will never know “why” a market does anything. Most losers in the markets think they must have reasons for making a trade based on all kinds of subjective junk. Not us.

Our method is objective, and 100% rule based. There is nothing to understand other than what the algorithm is telling us. Follow the rules and make money- it’s that simple.

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios 12/28/2024

1A – 25K

2A – 18K

3A – 8K