Bubba’s Equity Portfolios Weekly Update 9/23/2023

We have stated and taught repeatedly that the market forecasts itself- not traders or investors. We saw that this week- the market’s action was bearish as we saw lower highs and lower lows. Two of the three Model Portfolios had some gains this week.

Only GLD and XLE remain long, and every other security in the Model Portfolios is on a sell signal. While we cannot forecast duration of a trend, history has shown that markets tend to remain in a trend far longer than most expect. So we would not be surprised to see a long-lasting bear market.

Debt and more debt is crushing economic activity and drunken-sailor out of control spending is what both political parties offer us. While price is all that matters to us, the fundamental factors that would generate a long and destructive meltdown in stocks is certainly present.

**There are no new trades**

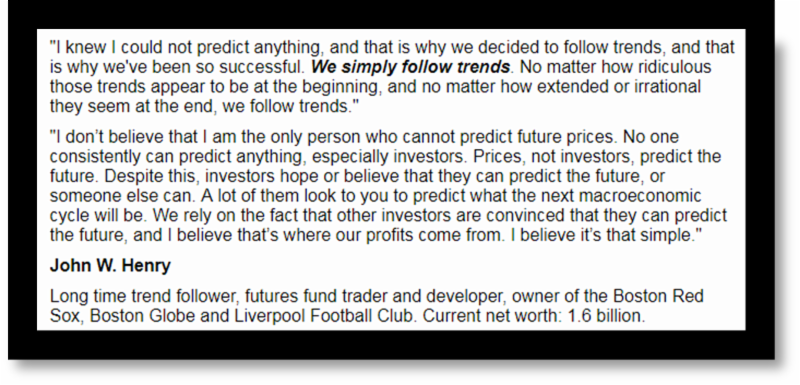

We rely on price and only price and this accounts for our long term profitability. Simply go with the flow and you will prosper regardless of everything else that goes into what makes markets. Price is reality- not trader’s opinions or forecasts.

We never know the exact date when the drawdown ends and we re-start the profit motor and make new highs. If you are not in the market, you cannot expect to make a profit.

Amateur traders are always looking for the “why” in trading when they should only focus of the “that” because we don’t know whys- but we do know the that. If a market is making higher highs and higher lows, “that” is the very definition of an uptrend. We usually will never know “why” a market does anything. Most losers in the markets think they must have reasons for making a trade based on all kinds of subjective junk. Not us.

Our method is objective, and 100% rule based. There is nothing to understand other than what the algorithm is telling us. Follow the rules and make money- it’s that simple.

**New trade alert**

NONE

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios Portfolios 9/23/2023

1A – 25K

2A – 18K

3A – 8K