Bubba’s Equity Portfolios Weekly Update 2/3/2024

The cash S&P 500 was +67.64 for the week closing at an all-time high. There is uniform bullishness across the board.

The Model Portfolios were lower this week as we got whipsawed in several sell signals. We are still in a strong uptrend and until sellers take charge, we will go higher- maybe much higher.

*New Trade Alert*

Reverse AMZN to long (1A/2A)

Reverse QQQ to long (1A)

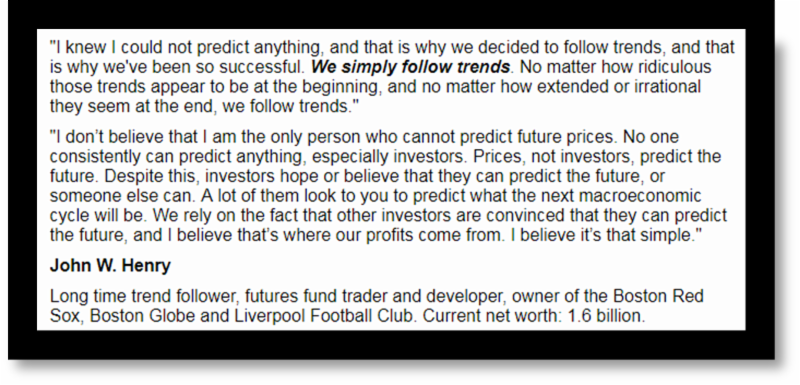

We rely on price and only price and this accounts for our long term profitability. Simply go with the flow and you will prosper regardless of everything else that goes into what makes markets. Price is reality- not trader’s opinions or forecasts.

We never know the exact date when the drawdown ends and we re-start the profit motor and make new highs. If you are not in the market, you cannot expect to make a profit.

Amateur traders are always looking for the “why” in trading when they should only focus of the “that” because we don’t know whys- but we do know the that. If a market is making higher highs and higher lows, “that” is the very definition of an uptrend. We usually will never know “why” a market does anything. Most losers in the markets think they must have reasons for making a trade based on all kinds of subjective junk. Not us.

Our method is objective, and 100% rule based. There is nothing to understand other than what the algorithm is telling us. Follow the rules and make money- it’s that simple.

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios 2/3/2024

1A – 25K

2A – 18K

3A – 8K