Saturday Trades Wednesday Update 7/16/2025

PPI Today – Markets lower after Tuesday’s late selloff

Markets had a late day selloff on Tuesday, they are lower this morning with PPI out at 8:30 this morning. The question about Tuesday’s selloff, the start of something or a natural pullback?

Volume is still light, the markets are still dull. There is no reason to believe the rally is over although it could be. We will watch and be ready. Earnings season began

Roll open SPY, and IWM to Thursday

This week’s call will be Wednesday at Noon EST

Open Ratio Trades – Roll Calls to July 18th

Sell to open MES September Futures

Buy to open July 18th 5 SPY ATM Calls

Sell to open MNQ September Futures

Buy to open July 18th 5 QQQ ATM Calls

Sell to open M2K September Futures

Buy to open July 18th 5 IWM ATM Calls

Sell to open MYM September Futures

Buy to open July 18th 5 DIA ATM Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

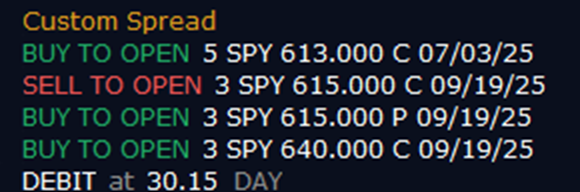

SPY