Saturday Trades Monday Update 7/14/2025

Market quietly lower

Markets opened lower last night on Tariff news, they have recovered 50% of those loses. They are quiet with very little action meaning they will probably continue to come back

Friday starts the next cycle in earnings with the banks reporting. There is not much to do but manage our open positions.. We will not be adding positions.

We will have our weekly Saturday call on Wednesday. I will send link and time later today

Roll open SPY, and IWM to Tuesday

Open Ratio Trades

Sell to open MES September Futures

Buy to open July 18th 5 SPY ATM Calls

Sell to open MNQ September Futures

Buy to open July 18th 5 QQQ ATM Calls

Sell to open M2K September Futures

Buy to open July 18th 5 IWM ATM Calls

Sell to open MYM September Futures

Buy to open July 18th 5 DIA ATM Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

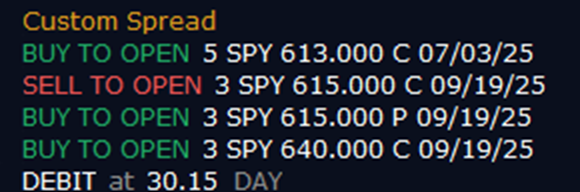

SPY