Bubba’s Equity Portfolios Weekly Update New Trades 7/5/2025

ASSIGNMENT VIDEO

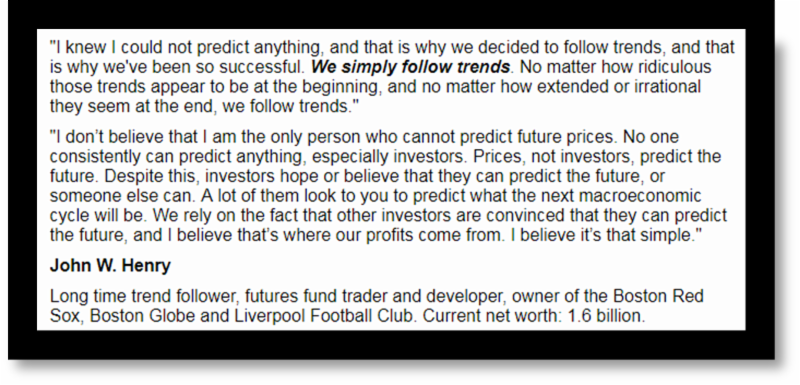

The cash S&P 500 was up 106.28 for the week closing at a new high. The trend is still higher until proven otherwise. However, our timing model is based on proven historic probability patterns- namely standard deviation from a mean based on proprietary look-back period. This means that whenever we go too far in a move, that move will end. It may just be a correction or an trend change. In general, the further we deviate from the mean, the greater the reaction in the opposite direction.

The timing model is at maximum bearishness right now and we expect a sharp decline. It is as bearish as 1987 and 2000.

We lost money this week:

1A -2656

2A -1749

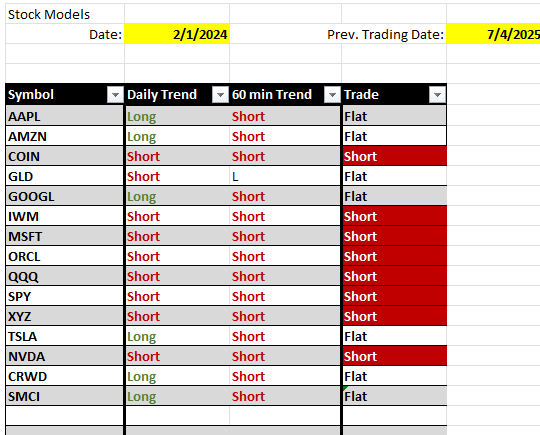

*New trade alert*

Sell MSFT from flat (1A/2A)

Here is the formula we use

For a Long Position

Buy the at the money Call

Sell a Put Spread starting with the at the money Put and using the recommended

distance for the Put Spread

For a short Position

Buy the at the money Put

Sell a Call Spread starting with the at the money Call and using the recommended distance for the Call Spread

ATM = At the Money

Long Put = Short Call Spread

Long Call = Short Put Spread

Remember the Groups are only updated once a week, although we have new trades during the week, changes to the Portfolios are only reflected on Saturday.

New Portfolios 7/5/2025

1A – 25K

2A – 18K