Saturday Trades Wednesday Update 1/8/2024

Markets higher – Probable selling opportunity

Markets higher after yesterday’s big selloff. This is probably a selling opportunity however, we have ADP jobs this morning. I wouldn’t get to committed to either side of the market until we see more action.

Volume and participation have been low, although picking up. I would expect next week to bring more action. Earnings season is beginning, participation should return

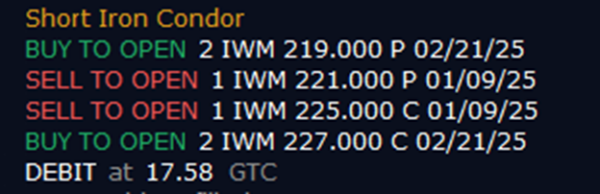

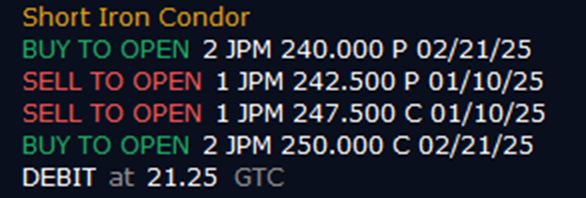

We added two new trades yesterday, JPM and IWM. JPM filled for some, you can work the same orders today

Roll SPY, IWM, and QQQ to Thursday

Futures Options Trades – OPEN

Buy 6 MGC February Futures – 2665

Buy to open 5 GLD January 10th 244 Puts

Bubba

Exercise and Assignment

Chat Room Link

New Trades

IWM

JPM

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

IWM – (14.31) (1100.00 Credit Collected)

Short 1 January 6th 236 Call

Short 1 January 6th 231 Put

Long 2 January 17th 238 Call

Long 1 January 17th 229 Put

Long 1 January 17th 218 Put

SPY- (2030.00) (1800.00 Credit Collected)

Short 1 January 6th 609 Call

Short 1 January 6th 600 Put

Long 2 January 24th 611 Call

Long 1 January 24th 600 Put

Long 1 January 24th 580 Put

QQQ- (29.62) (2300.00 Credit Collected)

Short 1 January 6th 542 Call

Short 1 January 6th 530 Put

Long 2 January 24th 544 Call

Long 1 January 24th 528 Put

Long 1 January 24th 505 Put

SLV – (6.58) (500.00 Credit Collected)

Short 1 January 6th 27.5 Call

Short 1 January 6th 27.5 Put

Long 2 March 21st 28 Call

Long 1 March 21st 28 Put

Long 1 March 21st 27 Put