Saturday Trades Wednesday Update 10/30/2024

Markets remain a mixed mess – stuck in consolidation

Markets remain a mixed mess – stuck in consolidation. They probably won’t commit to a direction until Friday or after the election. This is the tightest they have been wound in a long time.

COIN has earnings tonight after the close, cancel the trade. You can trade if you like but officially cancel

Roll New SPY, QQQ, and IWM to Thursday

Futures Options Trades

Sell 6 MES Futures – 5865

Buy to open 5 November 1st Calls 581 4.78

Sell 6 MNQ Futures – 20645

Buy to open 5 November 1st Calls 498 5.69

Bubba

Exercise and Assignment

Chat Room Link

New Trades

AAPL

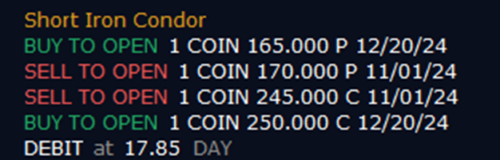

COIN

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

IWM – (26.68) (750.00 Credit Collected)

Short 1 October 28th 228 Call

Short 1 October 28th 224 Put

Long 2 December 20th 230 Call

Long 1 December 20th 222 Put

Long 1 December 20th 218 Put

QQQ – (27.07) (700.00 Credit Collected)

Short 1 October 28th 500 Call

Short 1 October 28th 490 Put

Long 2 November 15th 505 Call

Long 2 November 15th 485 Put

SPY – (29.03) (750.00 Credit Collected)

Short 1 October 28th 585 Call

Short 1 October 28th 575 Put

Long 2 November 15th 587 Call

Long 2 November 15th 573 Put

SMCI- (10.35) (400.00 Credit Collected)

Short 1 November 1st 50 Call

Short 1 November 1st 44 Put

Long 2 November 15th 52 Call

Long 2 November 15th 42 Put

JPM- (18.06) (1100.00 Credit Collected)

Short 1 November 1st 215 Call

Short 1 November 1st 205 Put

Long 1 November 15th 215 Call

Long 1 November 15th 225 Call

Long 2 November 15th 205 Put

GOOGL- (18.71) (1000.00 Credit Collected)

Short 1 November 1st 170 Call

Short 1 November 1st 162.5 Put

Long 2 November 15th 170 Call

Long 2 November 15th 160 Put

AMZN- (26.04) (1400.00 Credit Collected)

Short 1 November 1st 192.5 Call

Short 1 November 1st 185 Put

Long 2 November 15th 195 Call

Long 2 November 15th 185 Put

SLV – (5.22) (850.00 Credit Collected)

Short 1 October 28th 28 Call

Short 1 October 28th 28 Put

Long 1 November 15th 29 Call

Long 1 November 15th 31 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put