Saturday Trades Thursday Update 9/26/2024

Markets explode overnight – End of Quarter Rally?

Markets exploding to new highs overnight, more than likely an end of quarter rally. As we wrote yesterday, we are looking for a spot to sell.

We must be patient and wait for enough price action to get involved. If I were to bet, this is all window dressing into an overbought market.

We will see how it plays out, but don’t be too aggressive on either side of this market, it is too slow. This is a great learning opportunity, can you be patient enough to take full advantage of what’s to come

Roll SPY, QQQ, and IWM to Friday

HAVE ORDERS WORKING ON THE FUTURES, THERE COULD BE WILD SWINGS

Sell 6 MES Futures – 5762

Buy to open 5 568 Calls September 27th

Sell 6 MNQ Futures – 20028

Buy to open 5 482 Calls September 27th

Bubba

Exercise and Assignment

Chat Room Link

New Trades

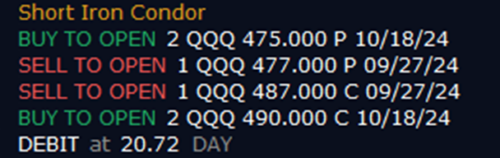

QQQ

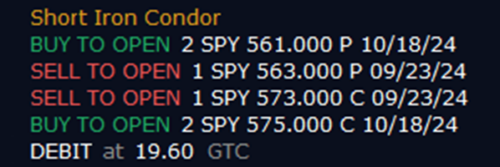

SPY

IWM