Saturday Trades Monday Update 9/9/2024

Markets higher – Look for levels to sell

The rally came earlier than we would like. We are looking for levels to sell. Be patient, and wait for confirmation that the rally is ending.

New Trades good as written

Roll SPY, QQQ, and IWM to Tuesday

Futures Ratio Spread – We are going back to short futures after this mornings rally. I will send an update when ready, nothing to do for now

Sell 6 MES Futures –

Buy to open 5 ATM Calls for September 13th

Sell 6 MNQ Futures –

Buy to open 5 ATM Calls for September 13th

Bubba

Exercise and Assignment

Chat Room Link

New Trades

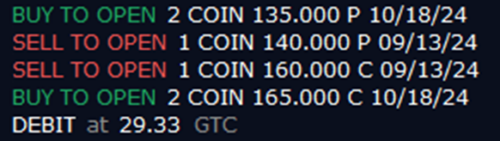

COIN

DIA

NVDA

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

MARA – (5.97) (300.00 Credit Collected)

Short 1 September 13th 19 Call

Short 1 September 13th 18 Put

Long 2 October 18th 20 Call

Long 1 October 18th 17 Put

Long 1 October 18th 13 Put

QQQ – (25.77) (2800.00 Credit Collected)

Short 1 September 9th 480 Call

Short 1 September 9th 475 Put

Long 2 September 20th 485 Call

Long 1 September 20th 470 Put

Long 1 September 20th 450 Put

NVDA – (21.84) (2400.00 Credit Collected)

Short 1 September 13th 130 Call

Short 1 September 13th 120 Put

Long 2 September 20th 132 Call

Long 1 September 20th 118 Put

Long 1 September 20th 102 Put

SPY – (21.83) (2500.00 Credit Collected)

Short 1 September 9th 560 Call

Short 1 September 9th 550 Put

Long 2 September 20th 562 Call

Long 1 September 20th 548 Put

Long 1 September 20th 540 Put

COIN – (13.68) (1000.00 Credit Collected)

Short 1 September 13th 220 Call

Short 1 September 13th 185 Put

Long 1 September 20th 220 Call

Long 1 September 20th 185 Put

SPY – (15.27) (300.00 Credit Collected)

Short 1 September 2nd 537 Call

Short 1 September 2nd 523 Put

Long 1 September 20th 539 Call

Long 1 September 20th 521 Put

IWM – (17.19) (1800.00 Credit Collected)

Short 1 September 9th 209 Call

Short 1 September 9th 201 Put

Long 1 September 20th 211 Call

Long 1 September 20th 222 Call

Long 2 September 20th 199 Put

QQQ – (19.51) (300.00 Credit Collected)

Short 1 September 2nd 455 Call

Short 1 September 2nd 439 Put

Long 1 September 20th 455 Call

Long 1 September 20th 439 Put

SLV – (5.22) (420.00 Credit Collected)

Short 1 September 11th 28 Call

Short 1 September 11th 28 Put

Long 2 November 15th 29 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put