Saturday Trades Wednesday Update 8/21/2024

Summertime Blues – Markets Dead

Markets are dead as we are in the slowest 2 weeks of the year.

We are in good shape with our positions and can handle movement either way. Our preference would be a medium sell off to help our rolls.

Roll SPY, QQQ , and IWM to Thursday. If you made any of the adjustments below, roll accordingly

On the open calendars, you have 3 choices.

1. Do nothing and continue daily rolls

2. Roll up both the long and short calls to around the money

3. Roll up the September call creating a short position

ALL NEW TRADES FILLED

Futures Ratio Spread

Sell 6 MES Futures – 5578

Buy to open 5 ATM Calls August 23rd 555 Calls

Sell 6 MNQ Futures – 19605

Buy to open 5 ATM Calls August 16th 475 Calls

Bubba

Exercise and Assignment

Chat Room Link

New Trades

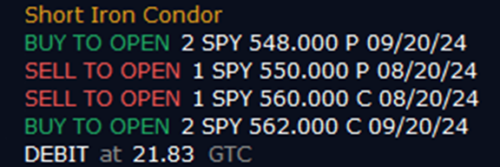

SPY

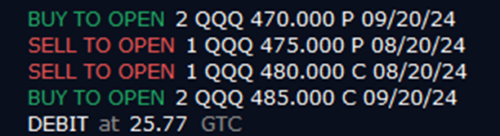

QQQ

NVDA

COIN

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

SPY – (15.27) (300.00 Credit Collected)

Short 1 August 19th 537 Call

Short 1 August 19th 523 Put

Long 1 September 20th 539 Call

Long 1 September 20th 521 Put

IWM – (17.19) (200.00 Credit Collected)

Short 1 August 19th 209 Call

Short 1 August 19th 201 Put

Long 2 September 20th 211 Call

Long 2 September 20th 199 Put

QQQ – (19.51) (300.00 Credit Collected)

Short 1 August 19th 455 Call

Short 1 August 19th 439 Put

Long 1 September 20th 455 Call

Long 1 September 20th 439 Put

SLV – (5.22) (250.00 Credit Collected)

Short 1 August 16th 28 Call

Short 1 August 16th 28 Put

Long 2 November 15th 29 Call

Long 1 November 15th 27 Put

Long 1 November 15th 25 Put