Saturday Trades Wednesday Update 7/10/2024

Up, Up and away

On Tuesday it looked like we could see a down day, once again the rally came and more record highs for the S+P and Nasdaq.

Another day of testimony for morons Yellen and Powell, CPI tomorrow and PPI Friday. Look for the rally to continue

Work the rolls at midpoint

Work to sell the extra options that expire on the 19th to lock in a profit, everyone’s will be a little different

I have sold the extra QQQ, SPY, AAPL and working the rest

MRNA filled, we will work the others 1 more day

Roll SPY, QQQ and IWM to Thursday

Ratio Spread using Futures and Options

•Short 6 MES (micro-S+P) Futures 5621

•Long 5 SPY July 12th 554 Call

Bubba

Exercise and Assignment

Chat Room Link

New Trades

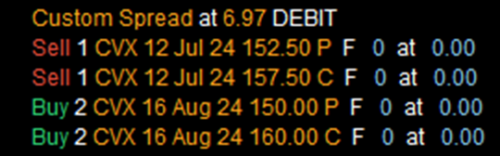

CVX

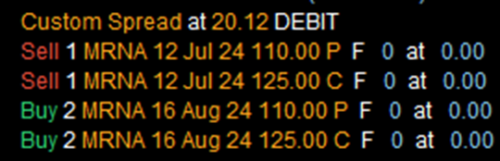

MRNA

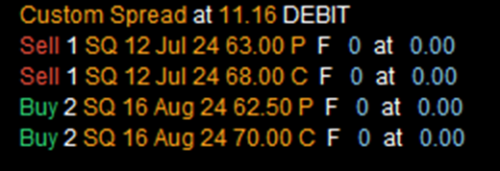

SQ

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

CHWY – (7.17) (105.00 Credit Collected)

Short 1 July 12th 27 Call

Short 1 July 12th 26 Put

Long 2 August 16th 27.5 Call

Long 2 August 16th 25 Put

NVDA – (24.77) (575.00 Credit Collected)

Short 1 July 12th 129 Call

Short 1 July 12th 123 Put

Long 1 August 16th 130 Call

Long 1 August 16th 132 Call

Long 1 August 16th 122 Put

Long 1 August 16th 120 Put

ROKU – (13.10) (245.00 Credit Collected)

Short 1 July 12th 62 Call

Short 1 July 12th 58 Put

Long 2 August 16th 65 Call

Long 2 August 16th 55 Put

IWM – (8.36) (404.00 Credit Collected)

Short 1 July 10th 202 Call

Short 1 July 10th 198 Put

Long 2 July 19th 204 Call

Long 2 July 19th 196 Put

JPM – (10.28) (700.00 Credit Collected)

Short 1 July 12th 200 Call

Short 1 July 12th 190 Put

Long 1 July 19th 200 Call

Long 1 July 19th 210 Call

Long 2 July 19th 190 Put

GLD – (10.24) (725.00 Credit Collected)

Short 1 July 12th 215 Call

Short 1 July 12th 215 Put

Long 1 August 16th 220 Call

Long 1 August 16th 222 Call

Long 2 August 16th 210 Put

SPY – (20.22) (1440.00 Credit Collected)

Short 1 July 10th 546 Call

Short 1 July 10th 536 Put

Long 1 July 19th 548 Call

Long 1 July 19th 555 Call

Long 2 July 19th 534 Put

QQQ – (20.22) (2540.00 Credit Collected)

Short 1 July 10th 482 Call

Short 1 July 10th 472 Put

Long 1 July 19th 485 Call

Long 2 July 19th 470 Put

NUGT – (7.25) (700.00 Credit Collected)

Short 1 July 12th 37 Call

Short 1 July 12th 35 Put

Long 1 July 19th 37 Call

Long 1 July 19th 43 Call

Long 2 July 19th 35 Put

AAPL – (10.10) (1325.00 Credit Collected)

Short 1 July 12th 215 Call

Short 1 July 12th 210 Put

Long 1 July 19th 220 Call

Long 2 July 19th 210 Put

RIOT – (3.05) (300.00 Credit Collected)

Short 1 July 12th 10.5 Call

Short 1 July 12th 10 Put

Long 2 July 19th 11 Call

Long 2 July 19th 9 Put

MARA – (8.21) (640.00 Credit Collected)

Short 1 July 12th 22 Call

Short 1 July 12th 20 Put

Long 2 July 19th 23 Call

Long 1 July 19th 19 Put

Long 1 July 19th 18 Put