Saturday Trades Tuesday Update 7/2/2024

Markets soft this morning – No real price action

Markets are soft this morning ahead of tomorrows ADP Jobs and ISM services number. It’s a holiday week and we can assume slow trade but be prepared for anything.

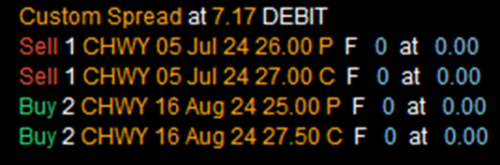

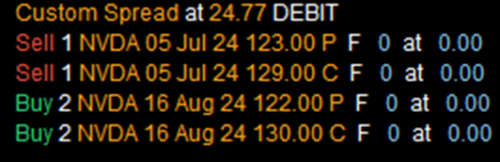

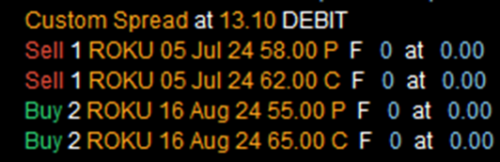

NVDA and ROKU filled, CHWY did not however I did reach for it and got filled at 8.50. You can work it or reach for it, your choice.

Roll SPY, QQQ and IWM to Wednesday

I would like to complete our rolls today, use the midpoint

Ratio Spread using Futures and Options

•Short 6 MES (micro-S+P) Futures 5521.5

•Long 5 SPY July 544 Calls 3.35

Bubba

Exercise and Assignment

Chat Room Link

New Trades

CHWY

NVDA

ROKU

OPEN TRADES

(Some of the call strikes could be different from what you are holding. I’m reflecting the rolls made on the open, some of you rolled again. This is a guide)

IWM – (8.36) (165.00 Credit Collected)

Short 1 June 27th 202 Call

Short 1 June 27th 198 Put

Long 2 July 19th 204 Call

Long 2 July 19th 196 Put

JPM – (10.28) (225.00 Credit Collected)

Short 1 July 5th 200 Call

Short 1 July 5th 190 Put

Long 1 July 19th 200 Call

Long 1 July 19th 202.5 Call

Long 2 July 19th 190 Put

GLD – (10.24) (245.00 Credit Collected)

Short 1 June 28th 215 Call

Short 1 June 28th 215 Put

Long 2 August 16th 220 Call

Long 2 August 16th 210 Put

SPY – (20.22) (790.00 Credit Collected)

Short 1 July 1st 546 Call

Short 1 July 1st 536 Put

Long 1 July 19th 548 Call

Long 1 July 19th 550 Call

Long 2 July 19th 534 Put

QQQ – (20.22) (890.00 Credit Collected)

Short 1 June 27th 482 Call

Short 1 June 27th 472 Put

Long 1 July 19th 485 Call

Long 1 July 19th 487 Call

Long 2 July 19th 470 Put

NUGT – (7.25) (350.00 Credit Collected)

Short 1 July 5th 37 Call

Short 1 July 5thh 35 Put

Long 1 July 19th 37 Call

Long 1 July 19th 40 Call

Long 2 July 19th 35 Put

AAPL – (10.10) (425.00 Credit Collected)

Short 1 July 5th 215 Call

Short 1 July 5th 210 Put

Long 2 July 19th 220 Call

Long 2 July 19th 210 Put

RIOT – (3.05) (250.00 Credit Collected)

Short 1 July 5th 10.5 Call

Short 1 July 5th 10 Put

Long 2 July 19th 11 Call

Long 2 July 19th 9 Put

MARA – (8.21) (540.00 Credit Collected)

Short 1 July 5th 22 Call

Short 1 July 5th 20 Put

Long 2 July 19th 23 Call

Long 1 July 19th 19 Put

Long 1 July 19th 18 Put